DirtSmuggler

Geotechnical

Hello

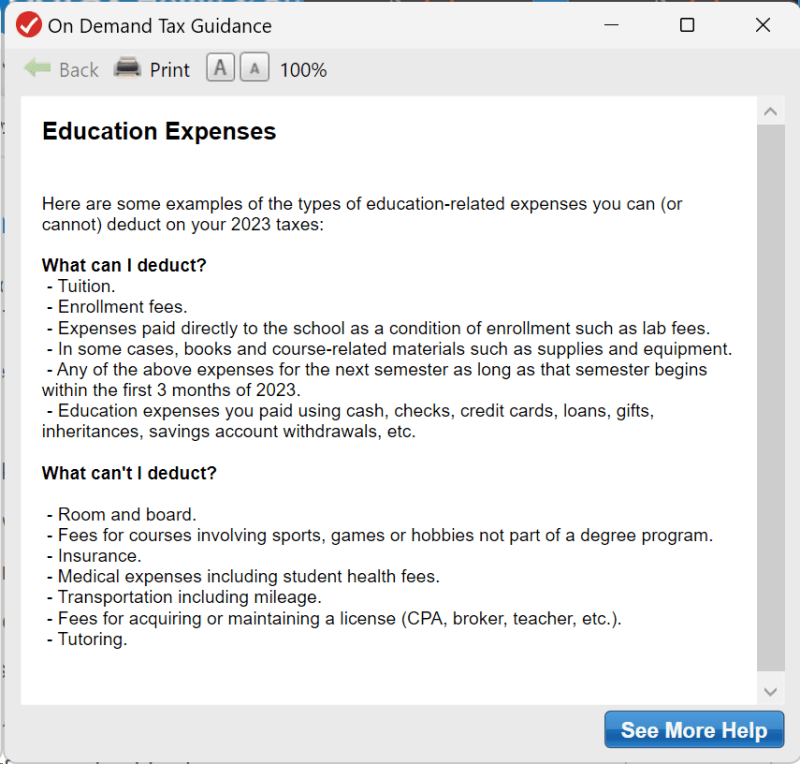

The current company I work for do not pay for PDH courses and credits, whether online or in person. I was wondering if the cost for attending the conferences for PDH credits are tax deductible? And if so, is it just the course/conference, or would the travel also be deductible? Anyone have any experience with this. My accountant said it's only tax deductible if I'm self employed. Another accountant told me I could since I need to keep my PE license to perform my work. A third accountant I spoke to said it is not deductible because you would incur those expenses to keep your job.

I found this from the IRS website;

-------------------

You may be able to deduct the cost of work-related education expenses paid during the year if you're:

A self-employed individual

An Armed Forces reservist

A qualified performing artist

A fee-based state or local government official

A disabled individual with impairment-related education expenses

To be deductible, your expenses must be for education that (1) maintains or improves skills needed in your present work or (2) your employer or the law requires to keep your present salary, status or job. However, even if the education meets either of these tests, the education can't be part of a program that will qualify you for a new trade or business or that you need to meet the minimal educational requirements of your present trade or business.

Education expenses incurred during temporary absence from your work may also be deductible, but the education must be to maintain or improve skills needed in your present work. After your temporary absence, you must return to the same general type of work. Usually, absence from work for one year or less is considered temporary.

Expenses that you can deduct include:

Tuition, books, supplies, lab fees, and similar items

Certain transportation and travel costs

Other educational expenses, such as the cost of research and typing

------------------------------

I'm understanding that as if I can deduct it.

The current company I work for do not pay for PDH courses and credits, whether online or in person. I was wondering if the cost for attending the conferences for PDH credits are tax deductible? And if so, is it just the course/conference, or would the travel also be deductible? Anyone have any experience with this. My accountant said it's only tax deductible if I'm self employed. Another accountant told me I could since I need to keep my PE license to perform my work. A third accountant I spoke to said it is not deductible because you would incur those expenses to keep your job.

I found this from the IRS website;

-------------------

You may be able to deduct the cost of work-related education expenses paid during the year if you're:

A self-employed individual

An Armed Forces reservist

A qualified performing artist

A fee-based state or local government official

A disabled individual with impairment-related education expenses

To be deductible, your expenses must be for education that (1) maintains or improves skills needed in your present work or (2) your employer or the law requires to keep your present salary, status or job. However, even if the education meets either of these tests, the education can't be part of a program that will qualify you for a new trade or business or that you need to meet the minimal educational requirements of your present trade or business.

Education expenses incurred during temporary absence from your work may also be deductible, but the education must be to maintain or improve skills needed in your present work. After your temporary absence, you must return to the same general type of work. Usually, absence from work for one year or less is considered temporary.

Expenses that you can deduct include:

Tuition, books, supplies, lab fees, and similar items

Certain transportation and travel costs

Other educational expenses, such as the cost of research and typing

------------------------------

I'm understanding that as if I can deduct it.