Oops409

Mechanical

- Apr 25, 2024

- 193

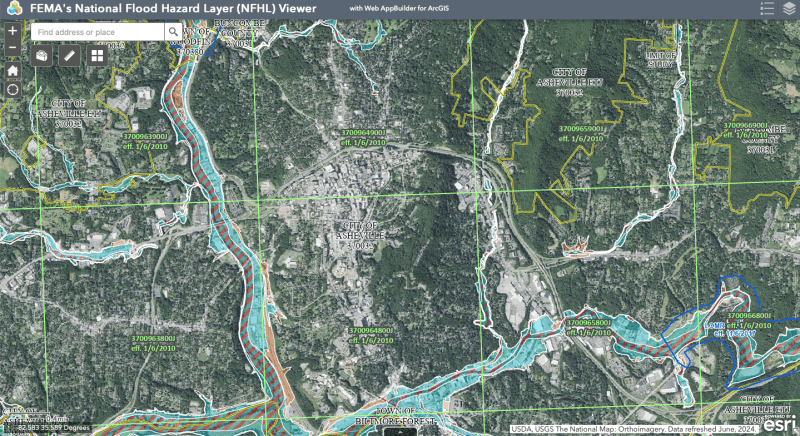

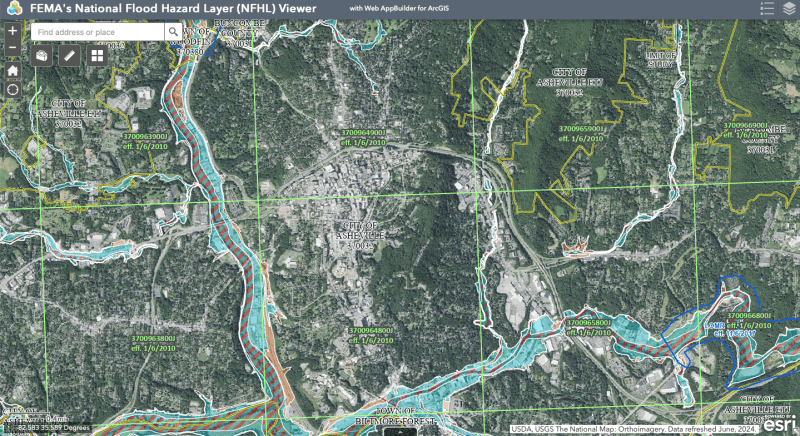

Only 3% of residents in Asheville, NC, for example, had flood insurance, according to an article I read. Looking at FEMA's Flood Maps, it is understandable why residents would not have flood insurance.

FEMA flood maps will need to be updated to reflect modern risks, and risks due to more and more urbanization and growth since maps were developed, along with whatever weather cycles we are now experiencing.

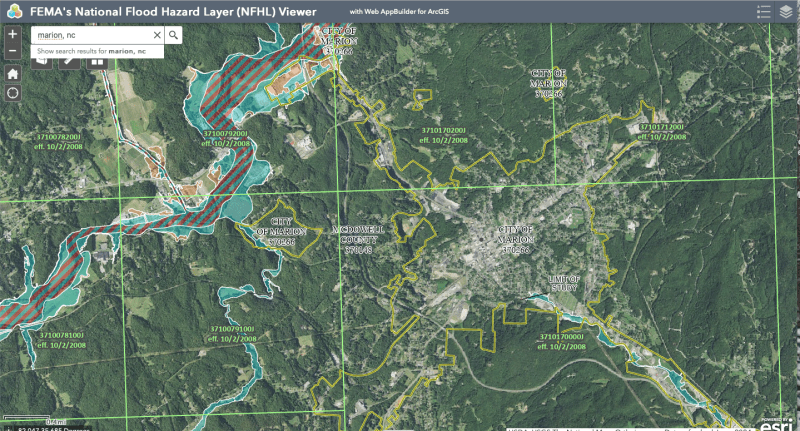

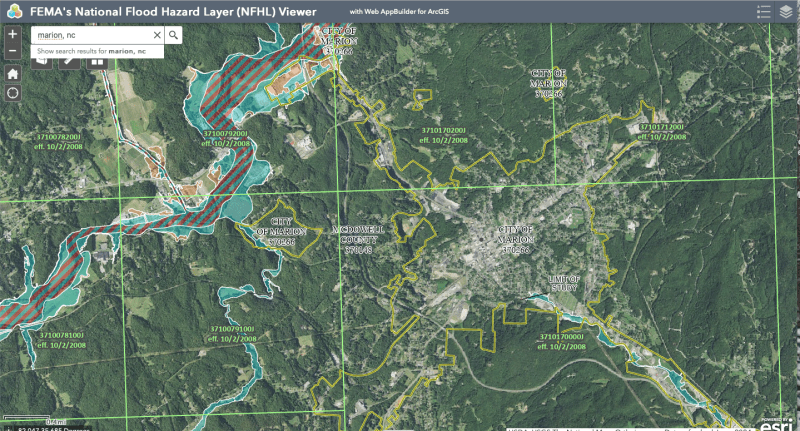

Marion, NC below

FEMA flood maps will need to be updated to reflect modern risks, and risks due to more and more urbanization and growth since maps were developed, along with whatever weather cycles we are now experiencing.

Marion, NC below